This is another in a series of Altacrest Capital articles on relevant topics for consumer brands that sell on eCommerce channels (please see Altacrest Insights).

In the fall of 2014 (centuries ago in eCommerce terms), my then-business partner and I were hustling to find selling channels for our high quality price point minibikes and go karts. We had just scored a big Black Friday event at Home Depot, and were in some other big box retailers. My partner told me he wanted to try Amazon Seller Central. The volumes were smaller, unlike big box PO’s, but the payment terms – every two weeks – and the control over pricing and brand imaging relative to big box retailers were remarkable. It ended up being one of the best decisions we ever made: superior and more reliable cash flow, and much better brand management capability than anything big box retailers had to offer.

As we all know and have reported in past Altacrest Capital articles, Amazon now dominates eCommerce the same way that Walmart dominates physical retail, both with a roughly 40% market share in their respective domains. In the summer of 2019, Amazon reported that small brands selling through Seller Central represented over half of its sales and the fastest growing part of its profitability. The concept of Seller Central wasn’t revolutionary – eBay and others have been selling this way for awhile – but the execution, with Prime membership, free 2 day shipping, all at scale, was revolutionary. The result is that Amazon has thoroughly disrupted retail by appealing to both brands and consumers. Most analysts expect Amazon to claim the title of largest retailer in the world by or before 2025.

My partner Brien Davis often uses an expression that Tim Laczkowski and I have adopted: trees tend not to grow to the sky. I remember back in the 2005-timeframe how often I heard that Walmart was unstoppable, its model was too difficult to compete against.

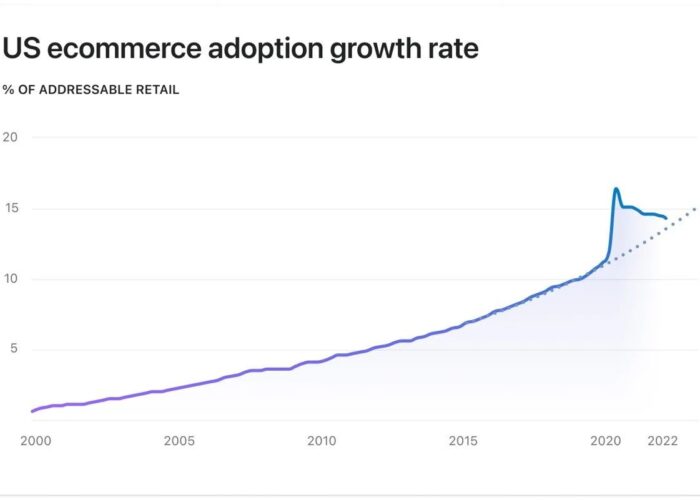

Today, similar things are being said about Amazon. However, there are many reasons why Amazon’s eCommerce market share is likelier to decrease in the future than go to over 50% and above. Probably the most important reason is that other large competitors have recognized Amazon’s value proposition and realize that, once two day delivery is executed reliably and at scale, Amazon’s model can be challenged. Don’t feel sorry for Amazon, the overall eCommerce pie continues to grow rapidly allowing meaningful growth for multiple players.

An alternative to Amazon: Walmart Plus / Fulfillment Services

In February 2020, Walmart announced to brand sellers a new channel/fulfillment option: Walmart Fulfillment Services (“WFS”). Subsequently, on September 1, 2020, Walmart announced Walmart Plus to consumers. The concepts are the most complete competitive responses we have seen to Amazon Seller Central/FBA (Fulfilled by Amazon) and Prime, respectively.

For sellers, features include:

- Two day delivery to the consumer

- Similar brand management capability to Amazon Seller Central (pricing, etc.)

- Two week pay cycle (same as Amazon Seller Central), far superior than typical big box retail terms.

Altacrest’s current understanding is that there is a 3 – 4 month backlog of brands trying to get on WFS. An application process is required. History with Walmart.com is helpful. Due the newness of the program, the number of sellers that qualify and are selling on WFS is not yet available. However, we know it is growing rapidly.

Walmart Plus is Walmart’s response to Amazon Prime. Like Prime, Plus is a membership program (Prime currently has 112 million members; Walmart has just started its Plus program). Today, Prime membership’s annual fee is $119, or a monthly fee of $12.98. Walmart Plus costs $98 per year or $12.95 per month. Both offer free two day shipping on selected brands and vendors. Walmart Plus also emphasizes other in-store benefits for Plus members, like gasoline discounts.

To much fanfare, Walmart acquired eCommerce engine Jet in 2016 for over $3 billion. Walmart has since dropped the Jet name (2019); however, the former Jet organization remains the center of Walmart’s eCommerce operations. It is our understanding that the operations of Walmart.com – still an option for consumers, with a range of shipping options – have been fully integrated into the former-Jet operation. Although to date Amazon has significantly out executed Walmart, the existence of the Jet infrastructure provides a measure of confidence in Walmart’s ability to succeed to the benefit of brand sellers.

On behalf of our portfolio companies, Altacrest will be monitoring WFS and Walmart Plus with great interest. There are significant advantages for brands to be on as many channels as possible, both for offense – exposure to incremental customers – and defense – non-reliance on any one channel. Rumors of mergers between Shopify and one of the large logistics businesses – UPS / DHL / Fedex – persist. The emergence of Facebook Shops for Facebook and Instagram accounts presents another opportunity for sellers and brands. While Amazon remains the 800 pound gorilla of eCommerce, competition is stiffening. This is good news for eCommerce-savvy consumer brands.