Since Covid entered the U.S. beginning around March 2020, the operating environment for consumer brands has been volatile and difficult: shocks, setbacks, and continuous change, particularly for digital brands. Despite the myriad of difficulties experienced over the last few years, today’s operating climate is starting to look much more stable.

SUMMARY

- Starting in 2020, a series of Covid-related macroeconomic “shocks” significantly altered the operating environment for consumer brands, in particular, digitally native brands. Impacts included:

- Artificial demand pull forward for many discretionary products, followed by demand “snapback” as travel possibilities opened back up again.

- Substantial and expensive supply chain disruptions.

- Rising inflation and interest rates that increased COGS, decreased profits, and significantly decreased credit market availability.

- Google, Meta, Amazon, and Apple permanently shifted direct-to-consumer digital customer acquisition costs (“CAC”) higher, and a large number of digitally native brands that experienced success during 2020 and 2021 continue to struggle. Surviving brands are learning to deal with this reality by focusing on the fundamentals: customer relationships, better products, and omnichannel marketing.

- Over this period, M&A market values for consumer brands, and digital consumer brands, have plummeted. 2023 estimates for consumer M&A are down 53% in value from peaks in 2021 (source: Price Waterhouse) to 77% of value for digital eCommerce brands (source: Pitchbook). There is a tone of cautious optimism for consumer M&A in 2024; Altacrest has noticed anecdotally that deal activity from the banking community is higher at the start of 2024 than at the start of 2023.

- A range of macroeconomic data suggests conditions are stabilizing and improving for brands, though far from “peak” conditions. Altacrest Capital believes that the combination of an improving – but not peak – earnings environment, and lower M&A valuations, make for a good time to consider investing in fundamentally sound, sustainable and defensible consumer brand businesses, as well as other businesses across the consumer value chain.

Some Data…

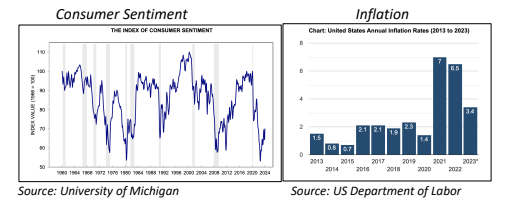

Consumer sentiment bottomed in early 2023 and has improved since then, though it’s still not at historical mean or median levels. * *Note the correlation of rising consumer sentiment to past economic growth cycles (eg, 1980 – 85, 1992 – 1999, and 2009 – 2020).

Inflation is returning to more normal levels, and more quickly than predicted. In the fall of 2023, most market expectations were for inflation to finish just above 4% in 2023. As is evident in the chart above, it finished much lower, at 3.4%.

Though not available in a simple chart, most large financial institutions (eg, Goldman Sachs, JPMorgan, Morningstar, Vanguard) are calling for:

- Lower interest rates going forward, driven by Federal Reserve Board reductions in 2H 2024 and into 2025 and ‘26 (2 – 3% Fed funds rate from over 5% today; Morningstar estimates a Fed funds rate of 1.75 -2% in 2026), and

- Slower U.S. economic growth in 2024, especially in 1H 2024, (ie, less than 2%) followed by improved economic growth in 2H 2024 and 2025 (closer to 2.5%).

It’s interesting to note that in the fall of 2023, many of these same institutions were much more pessimistic and / or cautious about i) the rate environment, and ii) the risks for a recession in 2024. That’s not a criticism, rather, an acknowledgment that recent economic data has simply been better than expected.

It is also important to note that most predictions are for rates to remain permanently higher than effective “zero” rates experienced starting in the mid-1990’s, driven by the higher federal debt load in the U.S.

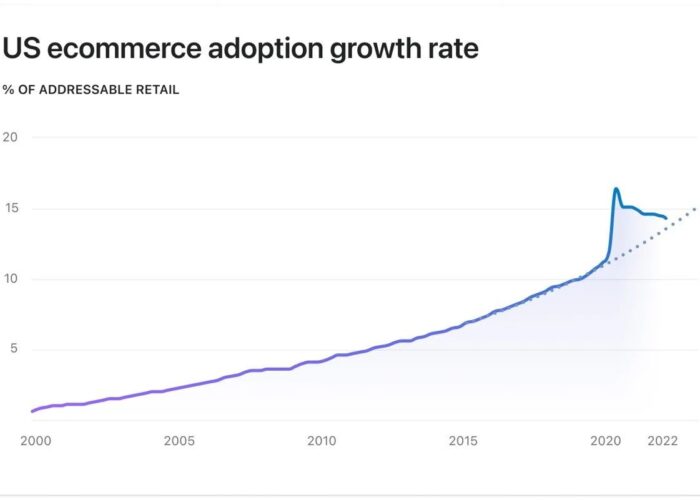

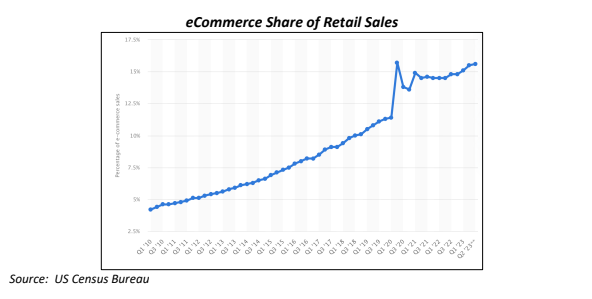

Altacrest has followed the chart above for some time. There are several important elements in this chart worth noting:

- There is a general pattern of eCommerce continuing to take share as a % of overall retail sales. Brands today understand that eCommerce is the latest “channel” of evolution in consumer marketing. The ability to tap into rich data about consumer behavior via eCommerce is a compelling way to develop a profitable relationship with a customer.

- While eCommerce has experienced significant growth as a percentage of overall retail since 2010, today, it stands at just over 15% of overall retail. This suggests more growth is available.

- There is an incredible amount of skepticism about digitally native brands given the extreme volatility experienced during the Covid period, referenced earlier in this memo and expressed well in the picture above:

- The “pull forward” and “snapback” are pictured clearly beginning in 2020 above

- However, note that, basically since the beginning of 2023, the old “trendline” continues.

- There is no question that the big eCommerce advertising businesses – Meta, Google, Amazon, and relatively new entrant Apple (see ios14) – have extracted value from the eCommerce advertising supply chain, and that unit economics experienced by brands from 2015 to about 2020 are not returning. The current “omnichannel” buzzword is real and required for successful go forward brands. However, brands still need to be competent in eCommerce as part of that channel strategy.

- A reminder about cycles: the Google “Panda” algorithm change that wreaked so much havoc for eCommerce brands happened in 2011. Would you have done well to invest in eCommerce in 2012?

The Covid driven volatility that occurred from 2020 – 2023 had a particularly negative impact on consumer brands. Economic cycles occur, and one can argue looking at the whole of the evidence above, that i) we’ve been through one, and ii) it’s beginning to turn. The consumer isn’t going away; it remains around 70% of the U.S. economy.

There have been sector specific “busts” over time. One example is the dot com bubble in 2000. For about 18 months that followed that bubble “bursting”, technology companies were shunned by markets. For years prior to 2000, dot coms had not been held accountable by investors to make profits or cash flow. This changed virtually overnight. There are parallels to the last few years with digitally native brands.

Important elements of today’s market conditions that suggest timing is improving for private investing in the “right” kinds of brands include:

- An improving, but not “peak”, earnings environment

- A more stable ad spend environment from 2022 or even 2023 (albeit less favorable unit economics than prior to 2020)

- Stable, cost effective supply chain

- Lower M&A valuations from 2021 peaks

- A range of improving macroeconomic data

Altacrest is actively seeking new investments in 2024. A longer list of investment criteria is provided at www.altacrestcapital.com. Because of our continued focus on sound fundamentals, our criteria has not changed much over time. Characteristics include: • Profitability and cash flow

- Real customer relationships

- Unique products with a sustainable product development engine

- Intelligent inventory management and cost discipline

- Omnichannel

- Leadership depth

- Intelligent, strategic, disciplined industry consolidation opportunities

We continue to seek out consumer brands with outsized growth opportunities, as well as strategic services across the consumer value chain.

Please reach out to Rick Sukkar, Partner, with any questions: [email protected]