Is your new partner the right partner to take your business to the next level?

A founder who is considering a potential acquisition partner in the sale of his/her growing eCommerce brand usually needs to answer the question “which partner will invest in my business, help me make tough decisions, and grow it to its potential?”

Why is this important? After all, the founder has already sold a controlling interest, the money is in the bank. So, why does it matter? There are many important reasons:

- First, it is very typical for a founder to have a “rolled” equity interest in the new entity, which can be a larger wealth-creating event than the first sale. At a minimum, it is highly likely this will create a relatively large “next” wealth event for the founder.

- Second, founders are typically passionate about the brand that they have created. They are passionate about the people they have hired who have helped them get there. They want to know the brand is in good hands.

- Third, founders are competitive and energetic people. Typically, they aren’t “done” when they sell. Whether it is a different role in the Company they founded, or expanding their network for future ideas / projects, the right partner can help them substantially in the next phase of their business and personal journey.

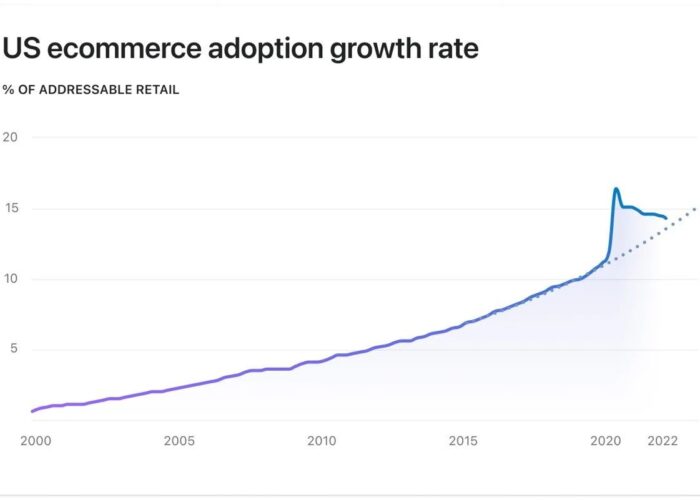

Altacrest focuses exclusively on eCommerce brands. Here are some thoughts on criteria for a new partner based on our experience, particularly as it relates to a consumer brand that sells primarily on eCommerce channels:

- Ability and demonstrated track record in paying a market price for the business. This is a practical reality for both sides.

- Ability to assess, in partnership with the founder, what the opportunities in the business are, and what has prevented the business from capturing those opportunities (including prioritization). Examples for an eCommerce brand would typically include:

- Experience in effectively marketing multi-channels

Selling on different channels should not be taken lightly. Success on one channel does not guarantee success on another. But, diversity of channels creates a more sustainable and more valuable enterprise. If a founder has built a brand with some degree of channel concentration (very common), the new partner should have demonstrated experience marketing effectively – and PROFITABLY – on other channels. It is typical that a new channel won’t be as successful as existing channels at first. So the ability to assess progress (or fail fast!) is critical, as is patience for longer term value creation when it is going well / as expected. Does the partner have experience and expertise growing a proprietary website, growing the Amazon 3P channel, other dot coms, etc.? - Willingness to invest in new people

Founders are often swamped with their responsibilities. They can be too busy to hire that extra key person(s), or just find the prospect daunting, sometimes because past key hires haven’t worked out. Is your new partner committed to hiring the people the business needs to grow? Does your partner have key people in their network? Or have demonstrated knowledge of what the key person “looks like”? - Scalability

Is the current business too reliant on an individual, sometimes in a role that is not driving the brand? How scalable are the existing processes? How much experience has your partner had in scaling for, say, double the existing size? People, facilities, processes, etc. - Infrastructure

Example: are you about to run out of space because of growth constraints, and has the partner built a new larger facility into the go forward economics, so there is no misunderstanding on what is required post close? - Philosophy and Chemistry

- When discussing the go forward business, is the potential partner you are interviewing a “yes man”, just agreeing with your ideas and not offering any of their own? Are they the other end of the spectrum: know-it-all and dug in, potentially endangering all the good that you have built? In our experience, the best fit “feels like” a constructive mutual push, built on mutual respect, recognizing the founder’s talents and the positive attributes of the business but also recognizing possible holes that should be filled in and opportunities that should be pursued.

- Having said all this, does the new partner understand there is a sequence that will be required for initiatives? Realistically assessing quarterly and annual priorities with agreement on the “big picture” is critical for actually executing on these initiatives. Rome wasn’t built in a day. What gets measured gets done. Plan the work and work the plan. Cue your favorite business cliché’ here, they’re all true for a reason.

- Have you thought through your preferred role in the go forward entity? Have you discussed it with your potential partner? What was the reaction / how did the discussion go?

- Are they “finance only”? Or do they bring operating and industry specific experience to bear?

- Is your partner hungry? Or fat and happy? You know which you prefer.

A founder should be diligencing a potential partner as much as the other way around. While there is no event quite like a sale, there is so much that happens post close, and just as much to think about. At Altacrest, we adhere to a few principles have helped us in our most successful situations:

- Remain focused on a specific industry, and grow a network of operating executives and subject matter experts in that industry

- The transaction is a two-way partnership

- Post close, do no harm. Discuss, assess, plan. Together

We wish you the best of luck in your search!!