Through sweat, tears, hard work, and perseverance, you’ve built a great small business. It’s continuing to prosper but the next level of growth will bring new challenges. Is it time for a partner? Is it time to take some “chips off the table” and sell all or a significant portion of your business? The decision to sell your business is an important one. Receiving a fair price for your business is a critical element in this decision. However, if your goal is to remain with the business and/or own a meaningful portion of the business following the financial transaction, choosing the optimal future partner is equally important. This article identifies many of the key considerations a business owner should contemplate when deciding with whom they want to partner in the next phase of the company’s growth.

PEOPLE

What role will I have as the seller going forward? What will happen to my employees after the transaction?

Although these conversations can initially be awkward, it is imperative that you as a seller and your new partner have a clear understanding of your desired role going forward. If you want to remain the primary driver of the business and maintain ultimate responsibility for growing the company, that needs to be communicated and agreed upon early in the transaction process prior to executing a Letter of Intent outlining the financial transaction. As part of this decision, it is necessary for the seller to have a strong understanding of his/her skill sets to ensure that he/she has the capabilities needed to meaningfully grow the business over the next 5-7 years. If your desire is to maintain the top leadership position, discuss early in the transaction process with your new partner how they will assist in the company’s development. Do they tend to be “hands on” or more of a silent financial partner? Frank discussion around expectations is best held prior to a transaction as opposed to post-transaction if/when complications arise.

If you are ready to exit or meaningfully downsize your role, discussion around this topic is equally important. How will the search for the new company leader occur? What level of involvement will the seller have in the decision-making process? What are the primary qualities needed in the individual that will succeed the current leader? Choosing a partner with experience managing through these transitions can be very important to the long-term success of the business.

Another important consideration to discuss is the future of the current employees. It will be critically important to any new partner that the right people are in the right roles within the company to allow it to grow to its full potential. Often as a company grows, there are a percentage of current employees which lack the capabilities to handle the next level of size of the business. If changes are needed, will new employees be added to augment the team, or will old employees need to be replaced? If replaced, what are severance expectations? Up front and honest communication between the seller and the new partner will set initial expectations. Additionally, discussion around how future performance will be measured and how decisions will be made with regards to personnel moves is important to establish early.

MAXIMIZING FUTURE VALUE

What skill sets/capabilities are important to drive future growth of the company and eventually a strong “second bite at the apple”? Will the new partner over burden the business with debt?

In addition to alignment with regards to people issues, it is very important to choose a new partner that understands your business and has the capabilities to maximize the future value of the business. This offers the seller a “second bite at the apple”, which when done effectively can lead to a second cash out for the seller that is larger than his/her initial cash out. Key areas where financial partners can add material value in helping to build a company typically include:

- Strong network – A strong network in your industry can be very helpful in identifying and attracting new employees, new customers, or opening doors to new growth opportunities

- Operations – Understanding of optimal supply chain and customer fulfillment functions can drive greater efficiency and allow the business to scale with fewer resources needed. This becomes more critical as companies grow to the next level

- Sales/Marketing – In addition to utilizing the financial partner’s network to upgrade employee talent and open doors to new opportunities, the optimal financial partner will have experience in your industry which they can bring to bear with direct understanding of which sales and marketing initiatives are more likely than not to be successful

- Financial – A strong accounting and finance function is critical as you scale so that mistakes can be avoided, and to ensure proper management tools are in place to measure performance of the business. Additionally, a quality financial partner will have experience in the amount of debt that is appropriate for your business and will not overly burden the company

VISION FOR THE BUSINESS

Am I comfortable with the vision and strategy that my partner wants to implement?

After years of hard work, most founders rightfully have a significant emotional attachment to their business. In addition to making sure you are comfortable with your new role and how your employees will be treated, it is important that you share a common vision of the future with your new financial partner. If a financial partner wants to take the business in a new direction, are you comfortable with this direction? Do you believe your partner’s vision is flawed or worse, unethical? If the answer is yes, you should carefully consider whether this is the partnership that is best for you. Although vision and strategy will likely evolve over time, upfront discussions on preferred direction can help minimize future disagreements.

With proper planning and execution, a financial transaction with a new partner can open significant growth prospects for the business, reduce the managerial burden on the founders, and create meaningful personal net worth liquidity for the founders. There are important considerations to debate. Open and honest communication early and often is the key determinant as to whether a financial transaction ultimately ends up a true overall success for the seller.

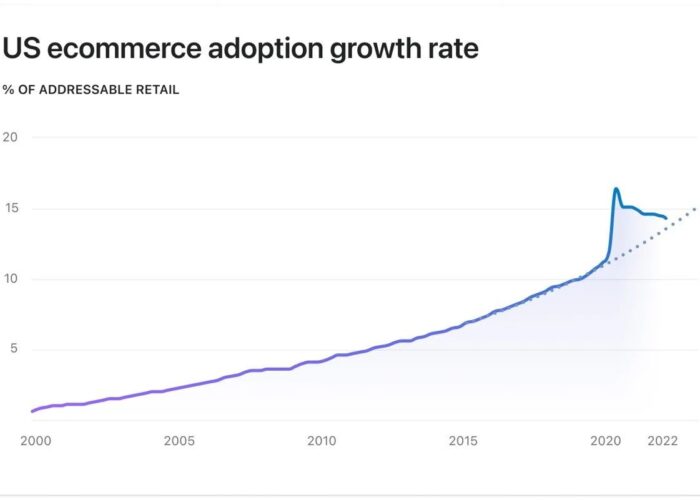

Altacrest Capital is a Dallas based private investment firm focused on investing in middle market companies in the Consumer Products (significant experience in eCommerce) and Business Services sectors. The founders of Altacrest Capital have executed over 200 transactions and have experience as C-suite operators growing businesses and facing obstacles similar to those described above. We seek to invest in family-owned and owner-operated businesses through buyout, recapitalization or growth equity investments. We partner with management teams and operators to provide capital, expertise and relationships to promote growth. For more information, visit www.altacrestcapital.com.