Both within our own portfolio companies, as well as within the eCommerce brands we have been in discussions with, we have observed some themes during these difficult times. We would like to share these themes, from the unique (understatement!) challenges faced, to mitigants and solutions that clever entrepreneurs are implementing on the fly. These themes range from marketing “customer facing” tactical changes to back end fulfillment. Not surprisingly, many of these changes relate to behavioral changes we have seen from eCommerce’s 600-pound gorilla, Amazon (still 6x the next largest eCommerce channel).

Marketing to the Customer

We consider March 11 as the calendar “marker”. The 11th was the day the NBA announced the suspension of its season and the President addressed the nation regarding COVID resulting in an immediate domino effect on our economy. Because we can easily observe daily (hourly) sales with these eCommerce businesses, the impact from sales on that day forward was extremely visible and dramatic.

Drilling down further, themes began to emerge:

- Sales on Amazon shifted, sometimes dramatically, depending on the category of the product / business. Were you considered “essential”, or in a “health” category? Were you considered “non-essential”? Almost certainly, if you were doing business on Amazon, you were impacted by this designation. While we cannot confirm this, Amazon certainly began “throttling” certain categories from a marketing perspective (re-marketing tactics, for example) reducing the number of customers driven to these products. From time to time, Amazon would directly communicate to certain businesses making them aware of new listing suspensions “until further notice” as well as other fulfillment challenges (discussed below). In most “non-essential” categories, we have seen Amazon “bottom” over the last few weeks. As of early May, sales have improved meaningfully over the late March/early April bottom but have yet to fully recover to last year’s levels in these impacted categories. “Essential” categories have largely seen sales increases and no fulfillment issues throughout the COVID crisis on Amazon. Within our own portfolio, despite lower traffic in certain categories we have continued to prudently spend on Amazon advertising with a focus on maintaining or growing market share and product rankings.

- eCommerce Traffic in Non-Amazon channels has increased significantly. While Amazon traffic, sales, and fulfillment shifted dramatically, so did other channels, in the opposite direction. As workers stayed at home, and social distancing took effect, social media traffic increased significantly. Depending on the week since March 11, and the channel, user traffic has been up 20 – 50%, sometimes higher. Additionally, depending on the product, the consumer was still buying, likely due in part to some frustration with finding an item or shipping timing on Amazon.

We can confirm that many businesses have throttled marketing spend back, which is very understandable in uncertain times. However, for businesses fortunate enough to still generate cash, this situation has been an opportunity to market to a larger, non-Amazon audience and balance sales channels away from Amazon. No one knows how permanent this change will be but being a multi-channel eCommerce business has certainly had advantages. Being multi-channel can lead to longer term benefits for businesses as well, which is why we have encouraged it in our portfolio. Eventually, when the economy recovers, we believe this channel approach will benefit the entire enterprise with more balanced channel sales and a more direct relationship with our core consumer (which is a challenge via the Amazon channel).

Fulfillment matters!

Never has the act of “getting stuff” been more top of mind for everyone. The convenience of Amazon Prime has been taken for granted, until now.

For some businesses, prior reliance on Amazon’s logistics system has been a significant hindrance. For periods and for certain categories, Amazon stopped receiving new inventory, and stopped shipping warehoused inventory, all in favor of “essential” categories.

Businesses have reacted in several ways to mitigate the impact, often via increasing self-fulfillment. This fulfillment approach has been challenging but necessary in many cases. First, management must ensure that office conditions are COVID-compliant with local regulations, both from the cleanliness of the office itself, to policies around workers maintaining social distancing while working, wearing masks, etc. While unemployment continues to ramp, getting willing workers into a fulfillment setting has occasionally been a challenge.

In addition to optimizing their own self-fulfillment, the current situation has led many companies to explore other viable fulfillment options beyond FBA (Fulfilled by Amazon), including:

- Other 3PL’s. Gas prices are down, and freight rates are down. There is an opportunity to explore other independent 3PL’s.

- Competitors to Amazon. Walmart.com has benefited from Amazon’s shifts. Through its fulfillment partners it represents another fulfillment option which has the further benefit of providing exposure to a new customer base.

- Amazon FBM (Fulfilled By Merchant). FBM is still an option available through and supported by Amazon. Due to Amazon’s restrictions on “non-essential” products, it is quite possible for self-fulfillment to achieve shorter shipping times than Amazon FBA. As is typical, a company needs to be compliant with Amazon’s terms (e.g. inventory availability/shipping accuracy), or risk listing implications.

Supply Chain Stress = Supply Chain Diversification

Businesses are also diversifying their supply chains as certain parts of their historical supply chain have become less reliable. While challenging, this could have long term benefits for businesses as we emerge from current economic challenges and resume growth.

Conclusions

Potential social and economic scenarios in the coming months are numerous as the United States and the rest of the world enters “Phase 2” of the battle against COVID-19. However, it is likely that consumer buying behavior will be impacted in the short and medium term until longer term safety is better understood and ensured. During this COVID impact period, Altacrest has focused on a few themes, to best prepare for the inevitable gradual recovery:

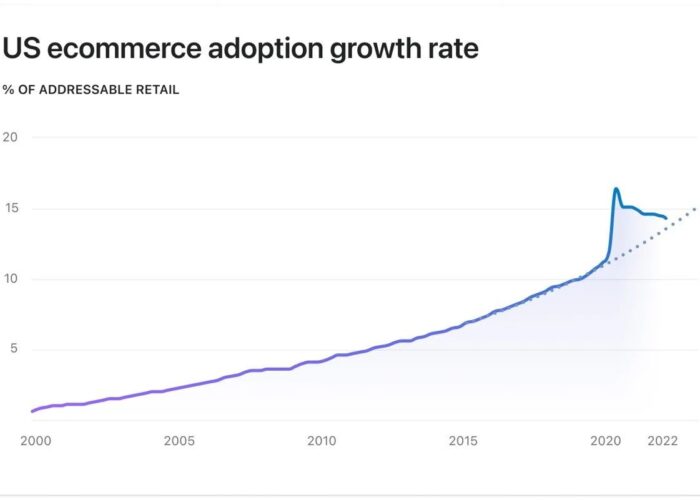

- eCommerce is a good place to be. We will remain focused on businesses that rely on eCommerce channels and/or have the potential to thrive in these channels.

- The opportunity to grow within non-Amazon eCommerce channels has never been greater. Reliance on the internet has never been greater – for information and interaction – and so is the opportunity for a more direct relationship with the consumer. We intend to capitalize on that opportunity where we have the financial flexibility to do so.

- “Back end” functions like fulfillment have to be revamped to account for a wide range of future scenarios, from supply chains, to office functions, to fulfillment via various channels. The entire chain must be nimble, flexible, and scalable.