Now over a year into the Covid pandemic in the United States, everyone is weary of Covid related news. Covid has severely impacted every aspect of our daily lives. Now, with hope on the horizon in the form of increased availability of vaccinations, there is also cause for concern, with Covid variants and new infections on the rise.

We have written before about how eCommerce brands have fared better than in-store brands during Covid, due to the convenience and safety of receiving goods at home relative to being in store. Regardless, Covid has not been kind to many consumer brands. Forced changes in pick pack and ship operations have impacted profitability. Shipping delays have impacted customer service and reviews as frustrated consumers who are used to receiving goods in 2 – 3 days have experienced significant delays. Increased freight times and costs have resulted in inventory delays and lost sales. Moreover, Amazon has significantly promoted “essential” goods over “non-essential”, which has had a substantive negative impact on those non-essential categories (obviously anything in the “health” or “cleaning” category has done extremely well during Covid).

In general, as we have reviewed businesses for sale, many have had a tough go during Covid. We expect most of these disadvantaged categories to benefit from pent-up demand when Covid lifts. However, there are certain categories unrelated to health and cleaning that have also benefited from Covid, primarily driven by consumers staying in their homes rather than going to the office for work, or going out for entertainment.

Covid Losers….

In general, categories that are related to style, fashion, and travel have been hit hard. This would include cosmetics, luxury apparel, jewelry, even sunscreen (Sources: Altacrest’s own experience; JPMorgan Research, November 2020). Given Covid dynamics, none of this is surprising, since consumers are generally not going out for entertainment or for work, and aren’t dressing up. Again, we expect there to be significant pent up demand for these products once the pandemic is under control. When evaluating quality companies that have been hit hard by the pandemic, Altacrest tries to take a “longer term” view on earnings by evaluating growth and historical earnings base in a non-Covid environment.

Covid Winners…

Booming demand for cleaning supplies and strong demand for certain health care products was not a surprising fallout of Covid. However, some of the knock on effects of consumers basically remaining housebound because of the pandemic have been somewhat surprising.

- Household goods: many categories related to home décor and improvement have been experiencing significant growth. Small decorative items, home comfort items, rehab projects, and remodels have been growing rapidly.

- Certain outdoor categories: outdoor activities have been spiking during Covid, considered a relatively safe harbor from the disease. Hunting and fishing accessories and golf related accessories are categories that have done very well.

- Certain enthusiast collecting hobbies are experiencing significant growth. Sports card collecting and trading has boomed during Covid.

- Apparel has split. Formal apparel has done poorly, while casual apparel – e.g., sandals, sweatshirts and t-shirts – has done well. Also, we’ve seen many examples of infant and children apparel do well during this time. Are the adults dressing up children because they aren’t bothering with themselves?

Conclusions for dealmakers

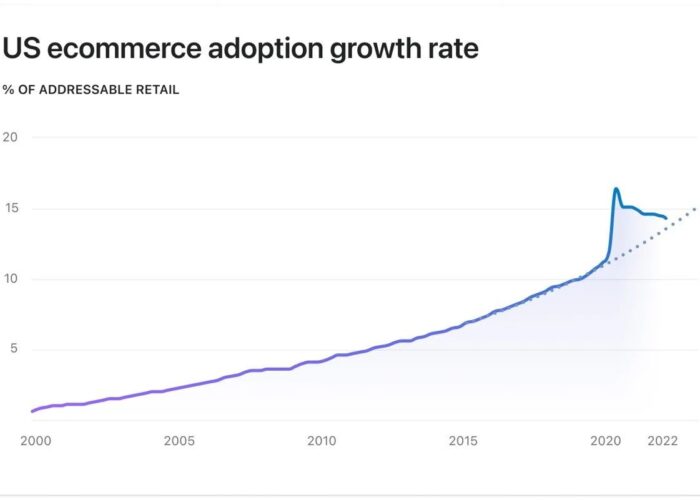

The main issue for evaluating business performance during Covid is determining what is sustainable, what is “normal”. Buyers, sellers, and financing sources need to look at a number of factors to make their best guess at how a business will behave over the next 5 years or so. How long has the brand been around? What were earnings during 2008 – 09 (assuming the brand was around then), and is that even a relevant comparison? Have earnings spiked since last March? How much have earnings been impacted by costs related issues related to required changes in operations made necessary due to Covid, as opposed to demand curve changes? Regarding demand: is the business heavily reliant on Amazon, and how much has demand been impacted by Amazon’s own retargeting efforts, as opposed to how the business marketed prior to Covid? Another thorny question: has Covid accelerated eCommerce categories sustainably, giving every eCommerce brand a positive bump going forward due to increased awareness (To a degree, probably, we would say). We all look forward to the day when Covid is in our rearview mirror. Until then, these questions will impact deal evaluation significantly and on a case by case basis.