The decision to sell a business can be difficult. Determining the right timing and manner in which to sell can be especially taxing.

Here are 3 questions you may ask yourself as you consider selling your business:

- Is the market right for me to sell?

- What is my business worth?

- What type of buyer do I want?

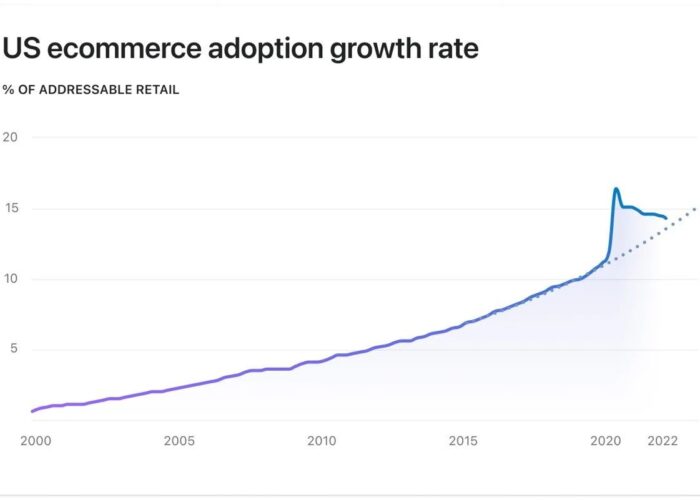

Similar to investing in publicly traded stocks, timing the market to sell a company is challenging. This is augmented by the fact that the sale process typically takes several months to complete. Market conditions and changes that are outside of a seller’s control can have an impact on valuation. Most business owners are well served to concentrate their energy on optimizing their business and not attempting to time the market. Buyers typically pay higher prices for companies that are well run, have a strong position within their industry, and possess continued growth prospects. In any economic market, companies with these attributes sell for higher valuations than businesses without these attributes.

In addition to determining when to sell, it is important for a business owner to determine what type of buyer he or she prefers. If the sole objective is maximizing value, regardless of purchaser, the company would likely benefit from hiring a reputable investment banker and running a full sale process. This will provide the broadest audience of potential buyers and can be used to maximize value. In many instances, a business owner will have strong preferences for who buys his or her company. Factors such as what happens to the employees, buyer’s capabilities to continue to grow the business, and relationship between buyer/seller can be of high importance. In these instances, a seller may be interested in a direct sales process with a specific buyer. Establishing relationships with potential direct buyers early in a seller’s decision process can expedite timing and reduce uncertainty. The market will ultimately decide the value of a business but having input from potential buyers early in the decision-making process can help an owner with their decision, as well as, eliminate some uncertainty around these critical issues.

While entertaining the idea of selling a company there is often confusion and apprehension from owners about life after the sale. After having been so involved in building and operating a business, it becomes the life of the owner. The uncertainty around life after a sale can lead to indecision and inaction by owners.

In addition to the topics above, there are other critical issues for a seller to consider earlier rather than later in the sales process. Most owners are unaware of these more nuanced considerations regarding a sale.

- Would I be willing to stay on if the buyer wants me to?

- Do I have the right team to continue to grow the business without me?

- Do I want to rollover equity with the buyer?

Ultimate valuation can be impacted positively if the seller will stay for a period of time after close. As well, if there is a strong leader and/or team in place at the company, valuation will likely be increased. Having a capable team to operate the business after the owner leaves provides a buyer with an option to have less disruption following the ownership transition. In most instances to achieve maximum value, owners will be asked by the buyer to have some economic interest after close. Whether it is in the form of rollover equity, seller note or an earn out, buyers want to make sure a seller’s interests are aligned for the business going forward.

Understanding the answers to these questions will influence the appropriate form of sale process. Take the time early in the decision process to identify how involved you want to be after close. Thoughtfully evaluate your team to determine if they could operate the business without your leadership. Seek out a potential buyer or financing source who can help you determine an early valuation for your business. It is important your expectations for the sale price and life afterwards are consistent with the market.